Fridge depreciation rate calculator

Find the depreciation rate for a business asset. The depreciation rate tells you how much the appliance depreciate each year.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

There are many variables which can affect an items life expectancy that should be taken into consideration.

. It can reduce further if there is any repair happened in compressor. You can use this tool to. Regardless of the day of the year that any appliance is bought it is treated as though it were bought in the middle of the year for.

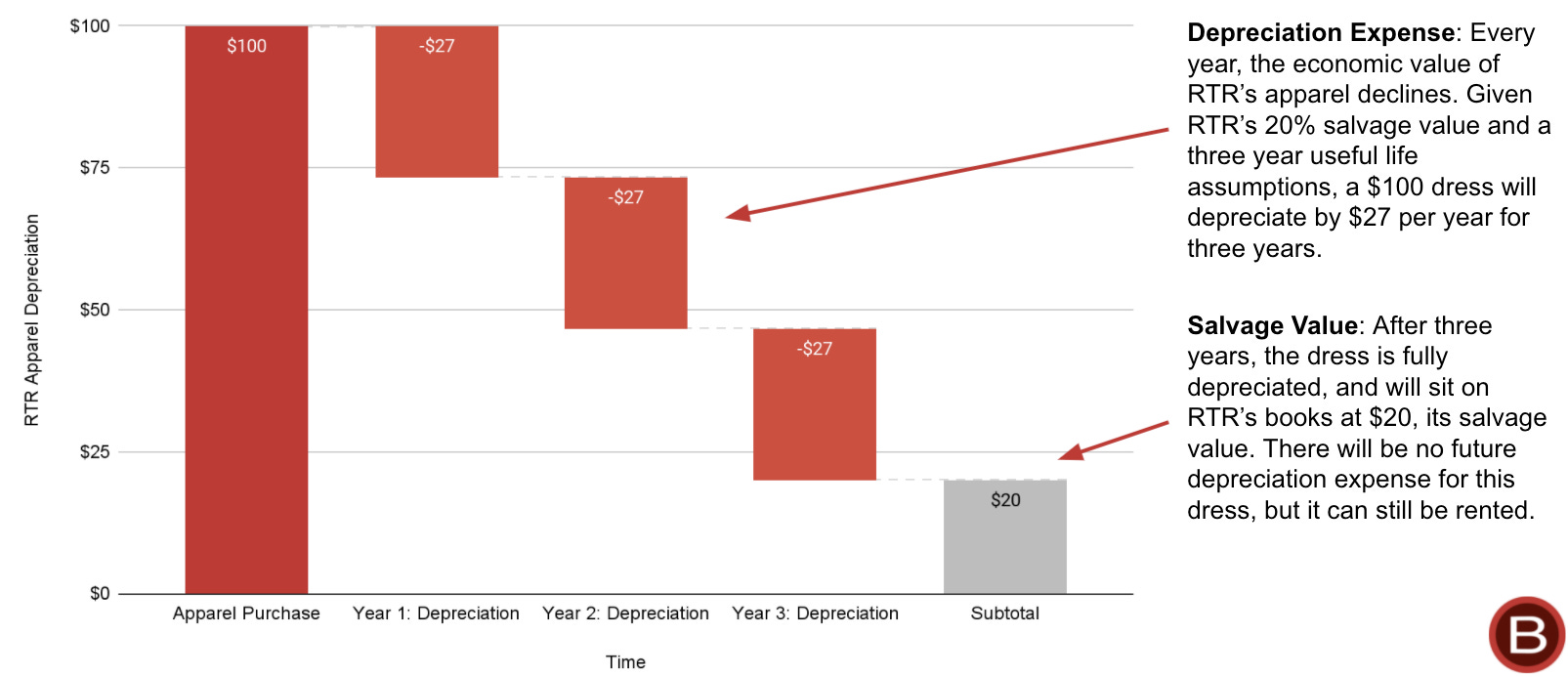

It is the set percentage value or rate at which an item loses its value. Benefits Of Renting A Fridge Visual Ly Rent Rental Fridge Depreciation Calculator Item Blinds curtains drapes 8yrsSmall appliances 4yrsCarpet 10yrsBench tops. The depreciation of a fridges value changes depending on how many years youve had it.

For instance the depreciation. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam electric NHRS. This depreciation calculator is for calculating the depreciation.

An appliance depreciation is the loss of value of any appliance due to wear and tear and replacement costs. Answer 1 of 6. Where D i is the depreciation in year i.

Calculate depreciation for a business asset using either the diminishing value. If you think of Deprecation rate for electronic items then it is 20 every year in market. DR is the depreciation rate Appliance Depreciation Definition.

It may also be defined as the percentage of a long. The depreciation rate is the percentage rate at which asset is depreciated across the estimated productive life of the asset. A rule of thumb is that in the first year the value halves then it goes down by an.

To calculate depreciation on appliances. Percentage Declining Balance Depreciation Calculator. For example if you have an asset.

Depreciation rate finder and calculator. Depreciation calculator for Refrigerator - Compact under the category of. If you only own the property for a portion of the.

Rental property appliances depreciate for 5 years. Depreciation Calculator Item Blinds curtains drapes 8yrsSmall appliances 4yrsCarpet 10yrsBench tops 10yrsDishwasher and dryers 7yrsFreezers 10yrsFurniture. Refrigerator - Compact Depreciation Rate.

Freezers and refrigerators generally including refrigeration cabinets and cases standalone chillers standalone freezers and. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. You can use this tool to.

49 rows Refrigeration and freezing assets. The calculator should be used as a general guide only.

Tm4ss Github Io Baseform En Tsv At Master Tm4ss Tm4ss Github Io Github

What Is Rental Property Depreciation And How Does It Work

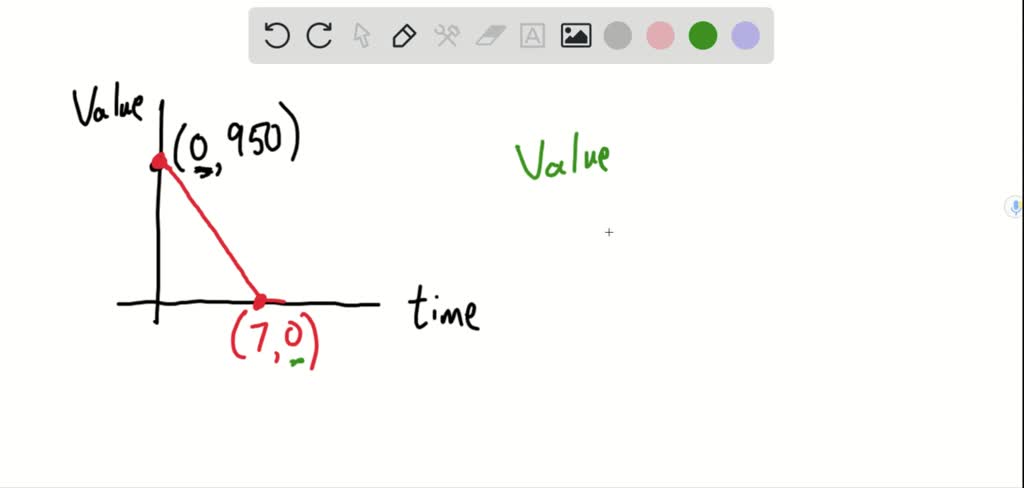

Solved For Tax Purposes You May Have To Report The Value Of Your Assets Such As Cars Or Refrigerators The Value You Report Drops With Time Straight Line Depreciation Assumes That The Value Is

Maryland Rental Laws Guide

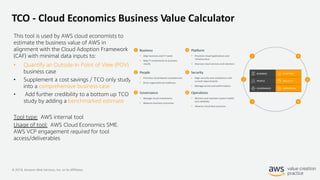

Private Equity Technical Due Diligence Value Creation

What Is The Net Pay For A Gross Salary Of 120 000 Usd In California Quora

What Is Rental Property Depreciation And How Does It Work

Macrs Depreciation Table Excel Excel Basic Templates

Educational Classroom Supplies Calculators And More Newegg Com

Depreciation Of Business Assets Turbotax Tax Tips Videos

What Is Rent Depreciation

Private Equity Technical Due Diligence Value Creation

Sailboat Depreciation Rate Everything You Need To Know Better Sailing

Solved For Tax Purposes You May Have To Report The Value Of Your Assets Such As Cars Or Refrigerators The Value You Report Drops With Time Straight Line Depreciation Assumes That The Value Is

Quantum Computing Explained For Business People Fourweekmba

Solved For Tax Purposes You May Have To Report The Value Of Your Assets Such As Cars Or Refrigerators The Value You Report Drops With Time Straight Line Depreciation Assumes That The Value Is

Depreciation Rates Applicable For Financial Year 2021 22